When it comes to ensuring your health and well-being, having the right private health insurance plan is crucial. In this guide, we will delve into the realm of private health insurance plans in the US for 2025, exploring the key benefits, top companies, emerging trends, and factors to consider when choosing the best plan for your needs.

Get ready to navigate the complex world of healthcare coverage with confidence and clarity.

Now, let's uncover the details of what makes these private health insurance plans stand out and how they can impact your healthcare journey.

Overview of Private Health Insurance Plans

Private health insurance plays a crucial role in the healthcare system of the United States, offering individuals and families the opportunity to access quality medical services without facing financial burdens. These plans are provided by private insurance companies and are typically purchased either independently or through an employer.Private health insurance plans come with a range of key benefits that distinguish them from public health insurance options.

Some of the advantages include a wider network of healthcare providers, shorter wait times for appointments and procedures, more personalized care options, and access to specialized treatments and facilities. Additionally, private health insurance often offers more flexibility in choosing doctors and hospitals, as well as additional services such as dental and vision coverage.

Comparison with Public Health Insurance

- Private health insurance plans typically offer more comprehensive coverage compared to public options like Medicaid or Medicare. This can include a broader range of services, treatments, and medications.

- While public health insurance may have lower premiums or cost-sharing requirements, private plans often provide more extensive benefits and higher quality care.

- Private health insurance allows for greater customization of coverage based on individual needs and preferences, offering a more tailored approach to healthcare.

- Public health insurance programs are funded by the government and may have eligibility requirements based on income or age, whereas private plans are purchased directly by individuals or through employers.

Factors to Consider When Choosing a Private Health Insurance Plan

When selecting a private health insurance plan, there are several important factors to take into consideration to ensure you choose the most suitable option for your needs. Understanding the different types of plans available, comparing coverage options, deductibles, and premiums, and evaluating your individual requirements are essential steps in making an informed decision.

Types of Private Health Insurance Plans

- Health Maintenance Organization (HMO): Offers a network of healthcare providers and requires a primary care physician for referrals.

- Preferred Provider Organization (PPO): Provides more flexibility in choosing healthcare providers, both in-network and out-of-network.

- Exclusive Provider Organization (EPO): Requires members to use a specific network of providers for coverage, except in emergencies.

- Point of Service (POS): Combines features of HMO and PPO plans, allowing members to choose in-network or out-of-network providers.

Comparison of Coverage Options, Deductibles, and Premiums

- Coverage Options: Evaluate the services covered, such as doctor visits, prescriptions, hospital stays, and preventive care.

- Deductibles: Consider the amount you must pay out-of-pocket before insurance starts covering costs.

- Premiums: Compare monthly payments for insurance coverage and assess affordability based on your budget.

Determining the Most Suitable Plan

- Assess Your Healthcare Needs: Consider your medical history, frequency of doctor visits, prescriptions, and any anticipated healthcare expenses.

- Network of Providers: Determine if your preferred doctors, hospitals, and specialists are included in the plan's network for optimal coverage.

- Cost Considerations: Balance premiums, deductibles, copayments, and coinsurance to find a plan that meets your financial requirements.

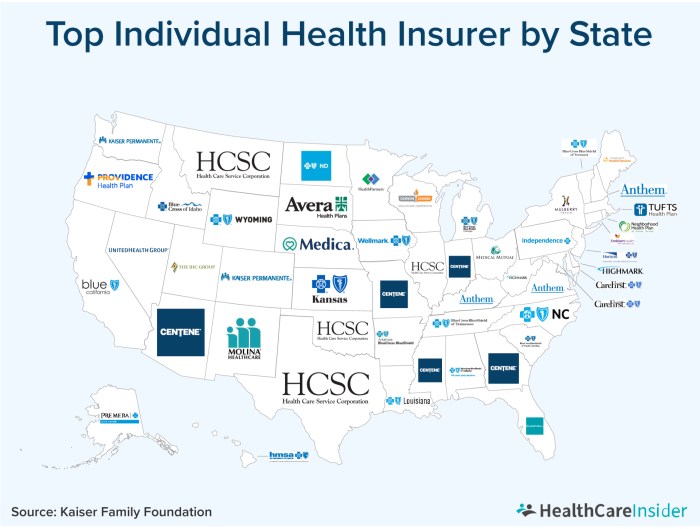

Top Private Health Insurance Companies in the US

When it comes to choosing a private health insurance provider in the US, there are several top companies that stand out in terms of coverage, network size, and customer satisfaction ratings. Let's take a closer look at some of the leading private health insurance companies for 2025.

1. UnitedHealthcare

UnitedHealthcare is one of the largest health insurance providers in the US, offering a wide range of coverage options for individuals and families. They have an extensive network of healthcare providers and are known for their excellent customer service. One unique feature of UnitedHealthcare is their innovative wellness programs that focus on preventive care and overall health and well-being.

2. Anthem Blue Cross Blue Shield

Anthem Blue Cross Blue Shield is another top private health insurance company known for its comprehensive coverage and large network of doctors and hospitals. They offer a variety of plans to meet the diverse needs of their members, including options for individuals, families, and seniors

Anthem is also recognized for their commitment to community health initiatives and charitable work.

3. Aetna

Aetna is a well-established health insurance provider with a reputation for high-quality coverage and personalized customer service. They offer a range of health plans, including HMOs, PPOs, and high-deductible health plans. Aetna is known for their innovative digital tools and resources that make it easy for members to manage their healthcare needs and make informed decisions about their care.

4. Cigna

Cigna is another top private health insurance company that focuses on providing comprehensive coverage and personalized support to their members. They offer a variety of health plans, including dental and vision coverage, as well as wellness programs and resources to help members stay healthy and active.

Cigna is also known for their commitment to diversity and inclusion initiatives within their organization.

5. Humana

Humana is a leading health insurance provider that offers a range of Medicare and Medicaid plans, as well as individual and family health insurance options. They are known for their focus on preventive care and wellness programs, as well as their commitment to improving the health and well-being of their members.

Humana also offers telehealth services and digital resources to make healthcare more accessible and convenient for their members.

Emerging Trends in Private Health Insurance for 2025

The landscape of private health insurance is constantly evolving, and as we look ahead to 2025, several trends are shaping the industry. From technological advancements to regulatory changes, these factors are influencing how private health insurance plans are designed and delivered to consumers.

Technology's Influence on Health Insurance Services

Technology plays a significant role in transforming the way health insurance services are provided to individuals. With the advent of telemedicine and digital health platforms, insurers are now offering virtual consultations and personalized health monitoring tools to their members. This not only enhances access to care but also promotes preventive health measures, ultimately leading to better health outcomes.

Regulatory Impact on Private Health Insurance Offerings

Regulatory changes at both the state and federal levels are also shaping the private health insurance landscape. For instance, the implementation of new laws or policies may impact the coverage options available to consumers, such as the inclusion of essential health benefits or the expansion of mental health services.

Insurers are required to adapt to these changes and ensure compliance while continuing to provide comprehensive coverage to their members.

Personalized Health Plans and Customization

One emerging trend is the shift towards personalized health plans and customization options for consumers. Insurers are increasingly offering tailored plans that cater to individual needs and preferences, allowing members to choose the coverage that best suits their healthcare requirements.

This trend reflects a growing demand for flexibility and choice in private health insurance offerings.

Focus on Preventive Care and Wellness Programs

In 2025, there is a greater emphasis on preventive care and wellness programs within private health insurance plans. Insurers are incentivizing members to prioritize their health through initiatives such as discounted gym memberships, nutrition counseling, and smoking cessation programs. By promoting healthy lifestyle choices, insurers aim to reduce healthcare costs in the long run and improve overall population health.

Closing Notes

As we wrap up our exploration of the best private health insurance plans in the US for 2025, it's clear that making an informed decision about your healthcare coverage is more important than ever. Remember to weigh your options carefully, consider your individual needs, and choose a plan that provides the coverage and peace of mind you deserve.

Here's to a healthier future ahead!

FAQ Section

What are the key benefits of private health insurance?

Private health insurance offers personalized coverage, access to a wider network of healthcare providers, shorter wait times for appointments, and additional services like wellness programs.

How do I determine the most suitable private health insurance plan for my needs?

Consider factors such as coverage options, deductibles, premiums, network size, and customer satisfaction ratings. Assess your healthcare needs, budget, and preferred providers to find the best fit.

What are the emerging trends in private health insurance for 2025?

Some emerging trends include the use of telemedicine, personalized health plans, and increased focus on preventive care. Technology is playing a significant role in shaping the future of private health insurance.