Exploring the realm of health insurance tips for chronic illness management, this introduction sets the stage for an informative journey filled with practical insights and valuable advice. From understanding the significance of health insurance to navigating coverage options, this guide aims to empower individuals dealing with chronic conditions.

As we delve deeper into the nuances of health insurance and chronic illness management, readers will uncover essential tips and strategies to optimize their healthcare experience.

Importance of Health Insurance for Chronic Illness Management

Health insurance plays a crucial role in managing chronic illnesses by providing financial support for ongoing medical care, treatments, and medications. Without health insurance, individuals with chronic conditions may face significant barriers to accessing necessary healthcare services, leading to worsening health outcomes and increased financial burden.

Financial Coverage for Medical Costs

- Health insurance helps cover the costs of doctor visits, prescription medications, hospital stays, and other medical treatments related to chronic illnesses.

- It can also provide coverage for preventive care services, such as regular check-ups and screenings, which are essential for managing chronic conditions and preventing complications.

- Having health insurance reduces out-of-pocket expenses for individuals with chronic illnesses, making healthcare more affordable and accessible.

Impact of Not Having Health Insurance

- Individuals without health insurance may delay or forgo necessary medical care due to financial constraints, leading to unmanaged chronic conditions and potential health complications.

- Without health insurance, the cost of medications and treatments for chronic illnesses can be prohibitively expensive, resulting in financial strain and limited access to essential healthcare services.

- Uninsured individuals with chronic illnesses are more likely to experience poorer health outcomes, higher rates of hospitalization, and increased mortality rates compared to those with health insurance.

Choosing the Right Health Insurance Plan

When it comes to managing a chronic illness, selecting the right health insurance plan is crucial. The right plan can provide the necessary coverage and benefits to help you effectively manage your condition and access the care you need. Here are some tips to consider when choosing a health insurance plan tailored to chronic illness management.

Types of Health Insurance Plans

- Health Maintenance Organization (HMO):HMO plans typically require you to choose a primary care physician and get referrals to see specialists. They often have lower out-of-pocket costs but less flexibility in choosing healthcare providers.

- Preferred Provider Organization (PPO):PPO plans offer more flexibility in choosing doctors and specialists without needing referrals. They have higher out-of-pocket costs but give you more control over your healthcare decisions.

- High-Deductible Health Plan (HDHP):HDHPs have lower monthly premiums but higher deductibles. They are often paired with Health Savings Accounts (HSAs) to help cover out-of-pocket costs.

Key Factors to Consider

- Network Coverage: Check if your current healthcare providers are in-network to avoid higher costs.

- Prescription Coverage: Ensure the plan covers the medications you need for your chronic condition.

- Out-of-Pocket Costs: Consider deductibles, copayments, and coinsurance amounts to estimate your total expenses.

- Chronic Condition Management Programs: Look for plans that offer specialized programs or services to help manage chronic illnesses.

- Annual Limits and Maximums: Review the plan's limits on coverage to ensure they meet your healthcare needs.

Understanding Coverage and Benefits

When managing a chronic illness, it is crucial to have a clear understanding of the coverage and benefits offered by your health insurance plan. This knowledge can greatly impact your ability to access necessary treatments and services without facing financial burdens.

Importance of Understanding Coverage Limits, Deductibles, Copayments, and Coinsurance

- It is important to know the coverage limits of your health insurance plan, as these limits can affect the types of treatments and services you can receive.

- Understanding deductibles is crucial, as this is the amount you must pay out of pocket before your insurance kicks in to cover costs.

- Knowing your copayments and coinsurance percentages is essential, as these determine how much you will have to pay for each medical service or prescription.

Impact of Pre-existing Conditions on Coverage and Benefits

- Having a pre-existing condition may affect the coverage and benefits provided by your health insurance plan, as some plans may exclude coverage for certain conditions.

- It is important to review your policy carefully to understand how your pre-existing condition may impact your coverage and benefits.

Essential Benefits for Individuals with Chronic Illnesses

- Prescription drug coverage is crucial for individuals with chronic illnesses who require ongoing medication.

- Coverage for specialist visits and treatments is essential for managing chronic conditions effectively.

- Mental health services should be covered to address the emotional and psychological aspects of living with a chronic illness.

Managing Costs and Expenses

When dealing with chronic illnesses, managing costs and expenses can be a significant concern for individuals. Here are some strategies to help minimize out-of-pocket expenses related to chronic illness management with health insurance.

Role of Prescription Drug Coverage

- Prescription drug coverage plays a crucial role in managing costs for individuals with chronic conditions. It helps offset the high costs of medications that are essential for managing the illness.

- Make sure to review your health insurance plan's prescription drug coverage to understand which medications are covered, copayment amounts, and any restrictions on certain drugs.

- If your current plan does not offer adequate prescription drug coverage, consider exploring other options or supplemental plans that may provide more comprehensive coverage.

Resources for Navigating Health Insurance Costs

- Look into patient assistance programs offered by pharmaceutical companies, which may provide financial assistance or discounts on medications for individuals with chronic illnesses.

- Utilize resources such as health advocacy organizations or non-profit foundations that specialize in assisting individuals with chronic illnesses in navigating health insurance costs.

- Consider consulting with a healthcare financial counselor who can help you understand your insurance coverage, negotiate medical bills, and explore options for managing costs effectively.

Utilizing Preventive Care Services

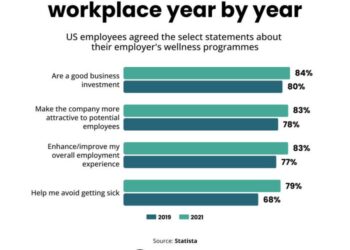

Regular preventive care services play a crucial role in managing chronic conditions effectively. By taking advantage of screenings, check-ups, and vaccinations covered by health insurance, individuals can prevent complications, detect issues early, and ultimately reduce healthcare costs in the long run.

Importance of Regular Check-ups and Screenings

Regular check-ups and screenings are essential for monitoring the progression of chronic illnesses, identifying any changes in health status, and addressing concerns promptly. By staying proactive and scheduling these appointments as recommended by healthcare providers, individuals can better manage their conditions and prevent potential complications.

- Regular check-ups help track key health indicators, such as blood pressure, blood sugar levels, and cholesterol levels, allowing for timely interventions and adjustments in treatment plans.

- Screenings for conditions like cancer, diabetes, and heart disease can help detect abnormalities early, increasing the chances of successful treatment and reducing the risk of complications.

- Preventive services also include vaccinations to protect against infectious diseases, which can be particularly dangerous for individuals with chronic illnesses.

Advocating for Preventive Care Services in Health Insurance Plans

It is important for individuals with chronic conditions to advocate for comprehensive coverage of preventive care services in their health insurance plans. By ensuring that these services are included and accessible without significant out-of-pocket costs, individuals can prioritize their health and well-being while managing their conditions effectively.

- Review your health insurance plan to understand the preventive care services covered and any associated costs or restrictions.

- Communicate with your healthcare provider to develop a preventive care plan tailored to your specific needs and health goals.

- Stay informed about recommended screenings and vaccinations based on your age, gender, and medical history to stay proactive in managing your chronic condition.

Final Conclusion

In conclusion, this guide has shed light on the intricacies of health insurance tips for chronic illness management, emphasizing the importance of informed decision-making and proactive healthcare planning. By leveraging the insights shared here, individuals can navigate the complexities of managing chronic conditions with greater confidence and resilience.

Questions and Answers

Can health insurance cover all medical costs for chronic conditions?

Health insurance can help cover a significant portion of medical costs for chronic conditions, but the extent of coverage may vary depending on the plan. It's important to review the details of the plan to understand what is covered.

How can I minimize out-of-pocket costs related to chronic illness management?

Strategies for minimizing out-of-pocket costs include using in-network providers, understanding your benefits, and exploring cost-saving options like prescription drug discounts or assistance programs.

What preventive care services should individuals with chronic illnesses prioritize?

Regular check-ups, screenings, and vaccinations are crucial preventive care services that can help individuals with chronic illnesses maintain their health, prevent complications, and reduce long-term healthcare costs.